Data protection in insurance has ceased to be merely a legal obligation and has become a key strategic element. Insurers handle highly sensitive information (from medical records and Social Security data to financial and risk profiles) that, if not properly protected, can lead to legal sanctions, loss of trust, and serious reputational damage.

In 2024, more than 5.5 billion accounts linked to insurance companies were compromised due to malware attacks specialized in information theft, a lack of security measures such as multi-factor authentication, and human errors such as sending data to the wrong recipients. This reality highlights the urgency of strengthening cybersecurity mechanisms and creating a strong data protection culture.

In this article, we will explore the fundamental pillars of regulatory compliance in insurance, the main challenges faced by insurers, best practices for protecting sensitive data, and how to move toward ethical, secure, and effective digitalization.

Why is data protection critical in the insurance sector?

In the insurance industry, data protection involves handling large volumes of personal information that, by its nature, is particularly sensitive. Insurance companies collect and process data that goes beyond the basics: it involves sensitive aspects of policyholders’ lives, from their health to their financial stability.

Therefore, correctly identifying and classifying this data is crucial, as it not only determines the level of protection it should receive, but also the legal obligations it entails.

Types of sensitive data managed by insurers

Insurers handle multiple categories of data that are considered specially protected under regulations such as the GDPR. These include:

- Health data: medical records, diagnoses, treatments, disabilities, and medical expert reports for life, health, or accident insurance.

- Financial data: income, debts, property, credit history, and use of financial products.

- Identifying data: name, address, Social Security number, ID/passport, voice recordings, or images.

- Biometric data: fingerprints, facial or voice recognition in identity verification processes.

- Behavioral data: driving patterns for car insurance, consumer habits, or physical activity data for personalized insurance.

This type of information, if mismanaged or leaked, can lead to discrimination, exclusion, fraud, or reputational damage for customers.

Risks associated with poor data management in insurance

As previously mentioned, inadequate data management in the insurance sector can lead to certain situations that put not only the integrity of the individual to whom the data belongs at risk, but also that of the insurance company. These are some of the scenarios:

- Data leaks: Security breaches that expose sensitive data and generate economic and reputational losses.

- Discriminatory decisions: When AI is not trained with anonymized data or contains biases, it can negatively affect certain groups.

- Penalties for regulatory non-compliance: Fines for violations of the GDPR, DORA, or the AI Law.

- Loss of customer trust: The perception of insecurity or lack of ethics in data processing can lead to customer churn.

For all these reasons, data protection in insurance must be integrated as a cross-cutting priority into the corporate and technological strategy of any insurance company.

Regulations you must comply with if you work in the insurance sector

Although each region has its own regulatory framework, they all share a common goal: to ensure data protection in insurance in a secure, ethical manner, and in accordance with the rights of data subjects. The regulations, while diverse, are interconnected: an insurer based in the United States that manages customer data in Europe must comply with the GDPR. Similarly, companies in Latin America that operate with European reinsurers or process data cross-border must also align their policies with European standards.

They also recognize fundamental customer rights, such as the right to access, rectification, and the right to be forgotten, and impose strict requirements on the secure storage and processing of data. For insurers, this poses the challenge of complying with multiple regulations simultaneously, ensuring the traceability and protection of personal information.

Below, we explore the main regulations by region and how they affect the insurance industry:

Europe: GDPR, DORA, Solvency II, and the AI Act

In Europe, the most robust framework for data protection in insurance is the General Data Protection Regulation (GDPR), which establishes clear obligations regarding consent, transparency, data minimization, and data subject rights. Insurers must ensure that data is processed lawfully, fairly, and securely.

Other key regulations are in addition:

- DORA (Digital Operational Resilience Act): requires insurers to demonstrate operational resilience to digital incidents, such as cyberattacks or system outages, including contingency plans and incident reporting.

- Solvency II: regulates the financial solvency of insurers and contains requirements regarding information protection, governance, and operational risk management, including data confidentiality.

- Artificial Intelligence Regulation (AI Act): imposes additional requirements on AI systems used in the insurance sector (such as risk assessment or fraud detection systems), classifying them as high-risk. It requires assessments such as the FRIA and guarantees of non-discrimination and human oversight.

Compliance in this context requires cross-functional coordination between legal, technology, and business teams, as well as tools that automate and document these processes.

United States: CCPA, SEC, and fragmented legislation

In the United States, insurance data protection is regulated by a fragmented network of federal and state laws that, in many cases, overlap or contradict each other. This complexity forces insurers to accurately map their legal obligations based on the type of data they manage and the state in which they operate.

One of the most relevant regulations is the Gramm-Leach-Bliley Act (GLBA), which requires financial insurers to implement robust information security programs, clearly communicate their privacy policies, and restrict data sharing with third parties.

HIPAA (Health Insurance Portability and Accountability Act) imposes strict requirements on the use, storage, and disclosure of protected health information (PHI). Organizations covered by HIPAA must adopt comprehensive security protocols and ensure the confidentiality of health information.

At the state level, the California Consumer Privacy Act (CCPA) and its enhanced version, the California Privacy Rights Act (CPRA), grant consumers additional rights, such as access, correction, and deletion of their data. This requires insurers to evaluate which aspects of their operations are covered by each regulatory framework.

Finally, recent regulations from the Securities and Exchange Commission (SEC) require publicly traded insurance companies to report cyber incidents within four days, requiring more effective response and cybersecurity protocols.

LATAM: Progressive adaptation to the european model

The insurance sector in Latin America is undergoing a regulatory transformation, with countries moving toward increasingly strict regulatory frameworks inspired by the European GDPR. Although legislation varies by country, the trend is clear: to require insurers to have greater transparency, accountability, and guarantees in the processing of personal data.

- In Brazil, the LGPD (Lei Geral de Proteção de Dados) establishes obligations similar to the GDPR, applying to all data processing activities, including those in the insurance sector.

- Chile and Argentina are undergoing reform processes to strengthen their laws and adapt them to European standards. In both cases, the creation or strengthening of independent supervisory authorities is planned.

- In Colombia, Peru, and Uruguay, laws already contemplate fundamental data protection principles such as legality, security, quality, and consent, requiring insurers to adopt internal policies and technical protection measures.

These regulations, although varying in their degree of maturity, reflect a common requirement: insurers must manage their customers’ personal information with transparency and accountability, ensuring its security from collection to transfer or storage.

Insurance Consumer Privacy Protection Act (ICPPA)

In 2025, the Insurance Consumer Privacy Protection Act (ICPPA) began its legislative journey in California, promoted by the Insurance Commissioner in response to growing concerns about the use and protection of personal data in the insurance industry.

Although it has not yet entered into force, its approval would mark a turning point in privacy regulation in this area. Therefore, we suggest key practices for insurers to prepare you for a new, more demanding regulatory landscape, in which compliance will not be optional.

The purpose of the ICPPA is to strengthen consumers’ privacy rights and establish stricter standards for the handling, storage, and sharing of data by insurers and their service providers. The law requires companies to implement stricter security measures, provide clear notifications about data use, and restrict its use to authorized purposes.

The California Insurance Commissioner will be the body responsible for monitoring compliance with this law and applying appropriate sanctions. These can include fines ranging from $5,000 to $1,000,000 for multiple violations, as well as criminal penalties of up to $50,000 or six months in prison for fraudulently obtaining information.

The implementation of this regulation reflects the growing pressure on insurers to manage personal data with greater transparency, ethics, and accountability, aligning with consumer expectations and the most demanding regulatory standards.

Common privacy challenges for insurers

Data protection in insurance does not only involve complying with local or international regulations. In practice, insurers face operational, technological, and strategic challenges that complicate compliance and increase their exposure to risk. These challenges, if not properly managed, can lead to security breaches, financial penalties, and loss of market confidence.

Security breaches and cyberattacks

Insurance companies are one of the main targets of cybercrime. According to the IBM Cost of a Data Breach Report 2024, the global average cost of a data breach is $4.45 million, but in the healthcare and insurance sectors, this figure rises to $10.93 million, the highest of all sectors.

Real-life examples

- In 2015, Anthem Inc. suffered a breach that affected 80 million personal records, including medical and policy data. It was fined $16 million by the Office for Civil Rights (OCR).

- In 2021, AXA Asia was the victim of a ransomware attack that leaked sensitive customer data from Thailand, Malaysia, Hong Kong, and the Philippines, demonstrating the sector’s global exposure.

Legal and operational complexity across multiple jurisdictions

Insurers operating internationally must comply with distinct and sometimes contradictory legal frameworks. This includes:

- The GDPR in Europe, with obligations regarding transparency, consent, and international data transfer.

- The CCPA/CPRA in California, which establishes expanded consumer rights.

- New laws such as the ICPPA (2025) or reforms in Mexico and Brazil, which introduce standards similar to the GDPR.

This regulatory framework requires adapting processes, policies, and technologies in each region, which increases compliance costs and hinders standardized data management.

Best practices and technological solutions for regulatory compliance

In an environment where cyber threats are increasingly sophisticated and costly, adopting proactive measures is no longer an option, but a necessity. In this context, automation and artificial intelligence have established themselves as key allies, resulting in organizations that have widely implemented these technologies in their security operations reducing the average cost of a breach by $2.2 million compared to those that did not, according to the latest IBM report.

Below, we’ve compiled three major strategic lines of action that every entity in the sector should implement to mitigate the risks associated with data breaches and sanctions for regulatory non-compliance:

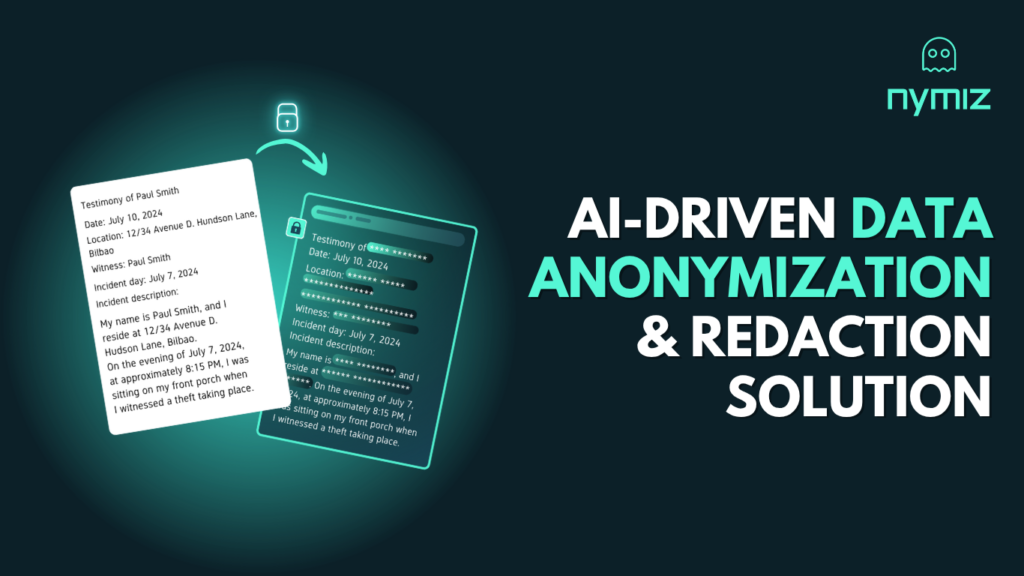

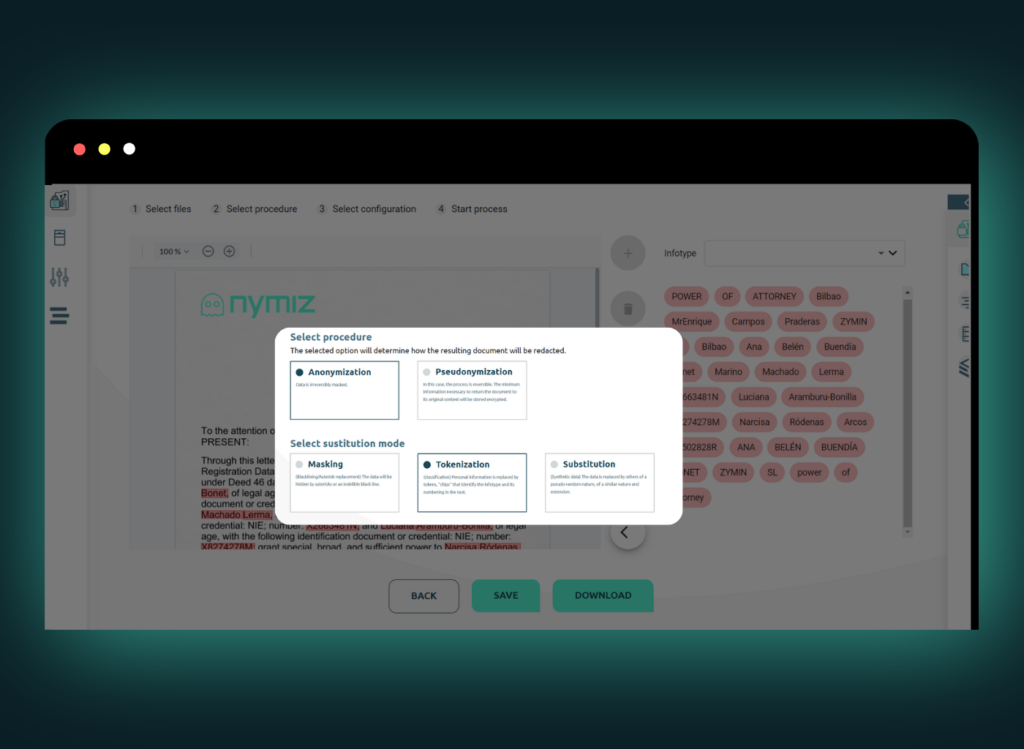

- Privacy by design: Anonymization, cloud security, and access control

Anonymization allows insurers to protect privacy without losing analytical value. By eliminating the identification of data subjects, they can securely process and share critical data, even in cloud environments, reducing the risk of breaches and misuse.

2. AI for proactive threat detection

AI is key to strengthening data protection in insurance. It detects anomalies in real time, identifies suspicious access, and triggers immediate responses, minimizing threat detection and containment times.

3. Continuous training and internal compliance management

Data protection starts with people. Training and raising awareness among teams reduces human risks, the main cause of breaches. And having a DPO ensures that the privacy strategy is effectively implemented, monitored, and enforced.

How AI is transforming the insurance industry

Artificial intelligence is revolutionizing the insurance industry by automating processes, optimizing customer service, and detecting fraud. However, this transformation also requires strengthening data protection in insurance, ensuring the legal, transparent, and fair use of personal information to comply with regulations and maintain trust.

Here are some real-life examples of how insurers have integrated AI into their operations and the results they have achieved:

- Mapfre has implemented more than 100 AI use cases, improving key areas such as loss assessment, customer service, and claims management. Thanks to these developments, it has streamlined internal processes and provided faster responses to policyholders.

- Allianz Direct, the digital subsidiary of the Allianz Group, uses AI algorithms to personalize policies and perform predictive analyses of customer behavior, thereby optimizing its data-driven business model.

- Achmea, one of the leading insurers in the Netherlands, has incorporated AI to automate claims management, reducing human error and improving the customer experience in complex procedures.

These applications demonstrate how AI brings real value to the industry, but they also require companies to strengthen their privacy and compliance policies, such as managing impact assessments like the Fundamental Rights Impact Assessment (FRIA), and implementing technical measures like data anonymization to ensure responsible use of these applications.

Adaptation, resilience, and strategy for a New Era

The insurance sector is undergoing a transformation marked by regulatory pressure and the adoption of technologies such as AI. This change requires rethinking management models and strengthening data protection in insurance, adopting best practices that allow for innovation without compromising privacy or competitiveness.

To move forward, industry leaders must prioritize four key pillars:

- Protect personal data through intelligent anonymization, which preserves the analytical value of information without compromising privacy. For example, by anonymizing medical records or expert reports, insurers can share them with AI systems or third parties without incurring regulatory non-compliance or exposing sensitive data.

- Invest in artificial intelligence (AI) not only as an efficiency tool, but also as a competitive advantage to anticipate risks, personalize products, and accelerate key processes such as claims assessment or customer service.

- Establish incident response teams with well-defined roles and clear protocols. This involves establishing secure communication channels and training staff to identify social engineering attacks, fraud, and phishing.

- Automate compliance processes, incorporating technological solutions that integrate privacy by design and enable rapid adaptation to regulatory frameworks.

Would you like to meet all these pillars efficiently and frictionlessly?

Book a personalized demo with Nymiz and discover how to automate data anonymization, reducing work time by up to 80% and ensuring privacy from the start.